Remember those changes that were coming to Form W-4? Guess what ...

Tax

Ever wonder if you or your employees could opt out of paying Social Security bas...

Wondering if you should switch your business's choice of entity to a C corp to c...

Like so many others, did you underpay your estimated taxes or not have enough fe...

While spending money simply to avoid taxes can be sub-optimal, there's a more im...

The 2020 inflation-adjusted limits on deductions for contributions to an HSA all...

The qualified business income deduction was created to provide savings opportuni...

How A Well-Maintained Balance Sheet Can Help You Decide This can be a hectic...

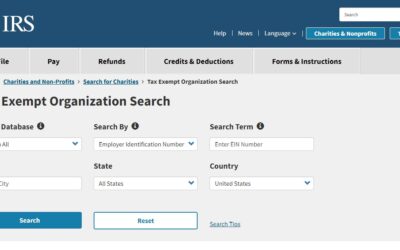

Wondering about an organization's tax-exempt status? Wonder no longer! The Tax E...

Thanks to the coronavirus, taxpayers have more time to pay their taxes. Learn mo...

How Real Estate Losses Can Help Offset Your Income For Tax Purposes Real...

Don't leave R&D tax credits on the table.

Don't let routine bookkeeping responsibilities result in an unexpected (and nega...

Find out how H.B. 110 addresses state and local tax considerations in a remote w...

Want to stay off the IRS audit list? Start by avoiding these 10 1040 faux pas.

Staying on top of nexus and state tax risk can help keep your business compliant...

What do you know about the mid-quarter convention?

When a property owner sells an asset that previously was used to offset ordinary...

We've all heard it – never do business with friends or relatives ... but how m...

As we wrap up 2022, it’s important to take a closer look at your tax and finan...

As we wrap up 2022, it’s important to take a closer look at your tax and finan...

Cost segregation is a tax strategy that helps business owners save money on the ...

Construction contractors are the unsung heroes of our cities and towns, building...

As a responsible business owner, you know the significance of Employee Retention...